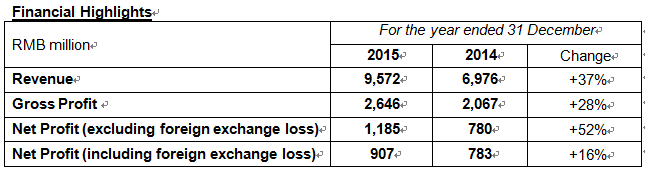

Aoyuan Announces 2015 Annual Results Revenue Up 37% to RMB9.57 Billion Sustainable Sales Growth with Sound Financial Performance

Date:2016-03-07

(7 March 2016 – Hong Kong) China Aoyuan Property Group Limited (“Aoyuan” or the “Company”, Stock Code: 3883), a renowned property developer in China, is pleased to announce its audited consolidated annual results for the year ended 31 December 2015.

Sustainable Sales Growth with Parallel Development in Domestic and Overseas Markets

In 2015, the Company maintained steady development and achieved revenue of approximately RMB9.57 billion, representing a y-o-y increase of 37%. Gross profit rose by 28% to approximately RMB2.65 billion, with gross profit margin at approximately 27.6%. Net profit excluding foreign exchange loss increased by 52% y-o-y to approximately RM1.19 billion, while net profit including foreign exchange loss increased by 16% y-o-y to approximately RMB907 million. Basic earnings per share amounted to approximately RMB29.2 cents. The board of directors recommended the payment of a final dividend of RMB8.80 cents per share.

In 2015, the Company recorded contracted sales of approximately RMB15.17 billion, achieving approximately 112% of its annual sales target. The contracted sales in 2015 tripled that in 2012, maintaining a growth rate higher than the industry average. Contracted sales from Guangdong province and non-Guangdong province accounted for approximately 44% and 49% respectively, while sales from overseas projects accounted for approximately 7%.

Aoyuan has successfully established a strategic plan in Australia market through localization. Its first overseas project, One30 Hyde Park Sydney, recorded outstanding sales performance with contracted sales of approximately A$213 million (approximately RMB1.02 billion) since its pre-sale in August 2015, receiving positive market response, while the average selling price reached approximately RMB126,957 per sqm.. Meanwhile, Aoyuan is also one of a few property developers in China who have gained access to local bank financing while entering into overseas markets.

Aoyuan continued to adopt a prudent land acquisition strategy in 2015, primarily focusing on Tier 1 and 2 cities and supplemented by lower tier cities. Expanding the land bank through diversified channels, Aoyuan has purchased a number of premium land parcels in Guangzhou, Zhuhai, Foshan and Nanning and etc. in China. Together with two premium land parcels in Sydney of Australia, the newly added GFA totaled approximately 2.50 million sq.m., laying a solid foundation for the Company’s sustainable development. As of 31 December 2015, Aoyuan possessed a total land bank of 13.33 million sq.m. in GFA, which is sufficient for the development needs of Aoyuan in about five years.

Sound Financial Performance with Credit Rating Outlook Upgraded to Positive by Fitch Ratings

Aoyuan upholds a prudent financial management while actively diversifying and maintaining its financing channels through onshore and offshore capital markets, further lowering borrowing cost and optimizing debt structure. From 2015 to date, the Company raised funds of approximately US$570 million and RMB4.4 billion on offshore and onshore capital markets respectively through diversified funding channels including syndicated loan, issuing senior notes and domestic corporate bonds, providing the Company with sufficient financial support. In addition, Aoyuan has completed the redemption of US$225 million senior notes due 2017 in two batches in November 2015 and February 2016 respectively.

As of 31 December 2015, the net gearing ratio of the Company was 62.7% and the cash collection ratio remained at a relatively high level of 82%, demonstrating sound financial performance. As result of fast growth in sales while remaining disciplined land acquisition and maintaining a consistent financial profile, Aoyuan’s corporate credit outlook has been upgraded to “Positive” by Fitch Ratings with a “B+” corporate credit rating affirmed.

2016 Outlook

Aoyuan management commented, “Amid a supportive policies environment for China’s real estate industry in 2015, Aoyuan endeavoured in its organic development while grasping market opportunities to pursue sustainable business growth, and thus achieved satisfactory results. In 2016, Aoyuan will hold a cautiously optimistic outlook towards China’s property market. We will continue to uphold our development strategy of ‘rapid development and rapid sales’, reinforce our footprint in the Pearl River Delta, upgrade composite real estate model incorporating themes of cultural tourism and regimen, and expand our foothold in Australia property market. Aoyuan will head for sustainable business development, thus delivering satisfactory returns to our shareholders.”

-End-