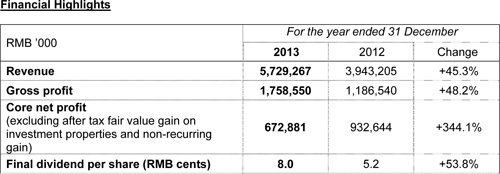

Aoyuan Announces 2013 Annual Results Revenue and Core Net Profit Up 45.3% and 344.1% to RMB5,729.3 Million and RMB672.9 Million, Respectively

Date:2014-03-18

Successful Implementation of "Developing Commercial and Residential Properties in Parallel" Product Strategy Entering Rapid Growth Phase

(18 March 2014 - Hong Kong) China Aoyuan Property Group Limited ("Aoyuan" or the "Company", Stock Code: 3883), a leading property developer in Guangdong Province in China, is pleased to announce its audited consolidated annual results for the year ended 31 December 2013.

Remarkable Operating Results

The Company achieved outstanding operating performance in 2013, with revenue up by 45.3% year-on-year to RMB5,729.3 million. Gross profit rose by 48.2% to RMB1,758.6 million and gross profit margin also increased to 30.7%. Net profit amounted to RMB752.1 million, while core net profit (excluding after tax fair value gain on investment properties and non-recurring gain) for the year amounted to approximately RMB672.9 million, representing a substantial increase of approximately 344.1% as compared to 2012. Basic earnings per share were RMB27.42 cents. The board of directors recommended the payment of a final dividend of RMB8.0 cents per share.

The Company"s management commented, "In 2013, amid the continued positive macro environment conditions with the gradual improvement of the Chinese economy and stable industry policies, the real estate market saw an upward trend as a whole, with both prices and quantities escalating. Aoyuan capitalized on the market opportunities and successfully implemented the product strategy of "developing commercial and residential properties in parallel" while adhering to the development strategy of "rapid development and rapid sales" to achieve encouraging results and enter a rapid development stage in the year.

Full-year Contracted Sales Exceeds RMB10 Billion

The Company"s total contracted sales exceeded RMB10 billion to reach RMB10.04 billion – a significant increase of 91% as compared to 2012, and approximately 118% of the full-year sales target which was earlier raised to RMB8.5 billion. Total contracted gross floor area (GFA) sold in the year was approximately 1.07 million sq.m., up approximately 27% year-on-year. The average selling price rose by 50% year-on-year to RMB 9,364 per sq.m. Aoyuan established a solid foundation on the development of commercial properties development, which contributed approximately 45% of total contracted sales in 2013.

With the effective product strategy of "developing commercial and residential properties in parallel", coupled with rapid development and innovative marketing models, a number of the Company"s major projects – including Guangzhou Aoyuan City Plaza, Guangzhou Aoyuan Spring Garden, Guangzhou Aoyuan Health Plaza, Chongqing Aoyuan The Metropolis, Guangzhou Aoyuan Beyond Era, Shenyang Aoyuan Convention Plaza, Zhuzhou Aoyuan Shennong Health Plaza – posted notable sales performance, which fuelled the growth in contracted sales.

Sound Financial Position with Broadening Financing Channels

In 2013, the Company continued to adhere to its prudent financial principles, expedited the capital return from sales, and continued to expand its finance channels to support the Company"s sustainable growth. The Company successfully issued additional offshore US$100 million and issued offshore US$300 million tranches of senior notes in early 2013 and 2014, respectively, which were well received by the international capital markets. The offshore financing demonstrates the capital market"s recognition of Aoyuan"s prospects, and lays a more solid foundation for the Company"s rapid development.

The Company has a sound financial position. As at 31 December 2013, the Company"s cash, bank deposits and restricted bank deposits amounted to approximately RMB4,711.6 million. Net debt ratio was maintained at a healthy level of 64%.

Expansion and Optimization of Land Bank

With its sound financial position, Aoyuan continued to expand and optimize its land bank and successively acquired a total of eight high-quality residential and commercial projects in Guangzhou, Chongqing, Foshan, Jiangmen, Yangjiang and Meizhou, which added new area for development of approximately 213,000sq.m.. Of these, three of the projects had already commenced presales during the year, generating excellent sales contributions.

As at 31 December 2013, the Company had 39 projects mainly located in Guangdong, Shenyang, Hunan, Chongqing and Guangxi, with a total land bank of 11.18 million sq.m. of GFA, 49% of which was located in Guangdong. The Company"s current reserves can meet its needs for project development in the next five to seven years.

2014 Outlook

The Company"s management concluded, "Aoyuan continued to sustain last year"s rapid growth momentum and achieved contracted sales totaling approximately RMB1.38 billion in the first two months in 2014, representing a year-on-year increase of 146% and establishing a solid foundation for the Company"s development in 2014. The year 2014 marks the second year of a new rapid development cycle. We will continue to adhere to the Company"s project and development strategies, enhance the efficiency of all aspects of management and control to ensure the realization of the Company"s sales, project delivery and profit margin targets. In addition, we will continue to stay abreast of market conditions and pay attention to tier-one and tier-two cities as we strive to win projects in the tier-one cities and their peripheral areas, develop new projects in the neighboring areas with our existing projects, and step up efforts in exploring "three-old transformation" and urban renewal projects. We believe that all the members of the Company will strive to boost the Company"s business to a new high and bring substantial and sustainable returns to our shareholders.