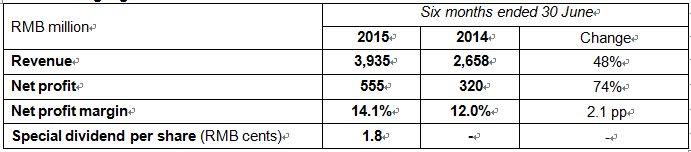

Aoyuan Announces 2015 Interim Results Revenue Up 48% to RMB 3.94 Billion

Date:2015-08-12

Aoyuan Announces 2015 Interim Results

******

Revenue Up 48% to RMB 3.94 Billion

Net Profit Up 74% to RMB555 Million

Sustainable Sales Growth with Diversified Financing Channels

Financial Highlights

(12 August 2015 – Hong Kong) China Aoyuan Property Group Limited (“Aoyuan” or the “Company”, Stock Code: 3883), a renowned property developer in China, is pleased to announce its unaudited interim results for the six months ended 30 June 2015.

Sustainable Sales Growth with Parallel Development in Domestic and Overseas Markets

In the first half of 2015, the Company achieved revenue of approximately RMB3.94 billion, representing a y-o-y increase of 48%. Gross profit margin remained stable at approximately 29.4%. Net profit amounted to approximately RMB555 million, representing a significant y-o-y increase of 74%. Net profit margin increased to 14.1%, up 2.1 percentage points y-o-y. The board of directors recommended the payment of a special dividend of RMB1.8 cents per share.

In the first half of 2015, the Company achieved contracted sales of approximately RMB6.07 billion with contracted GFA sold of approximately 822,000 sq.m., representing y-o-y increases of 18% and 53%, respectively. Contracted sales contribution mainly came from Guangzhou Aoyuan City Plaza, Guangzhou Aoyuan Beyond Era and Guangzhou Luogang Aoyuan Plaza.

Aoyuan has laid a solid foundation for parallel development in domestic and overseas property markets. In August 2015, One30 Hyde Park Sydney has obtained the Stage 2 development approval from the City of Sydney Council. In addition, Aoyuan has obtained an A$60 million loan from Commonwealth Bank of Australia, one of the Big Four Banks in Australia, which amounts to 50% in land acquisition with the total borrowing cost does not exceed 5% per annum. Besides successfully gaining access to local financing channels, Aoyuan has established good credit record in Sydney.

Solid Financial Performance with Diversified Financing Channels

The Company upholds sound and prudent operational and financial management while actively diversifying its financing channels. As at 30 June 2015, the net gearing ratio to 72.6% and the cash collection ratio remained at a relatively high level of 88%, demonstrating solid financial performance.

The Company strives to explore new financing channels and seizes market opportunities to promote the diversification of financing channels in domestic and overseas capital markets. In the first half of 2015, the Company has made three successful refinancing activities. In April 2015, the Company issued a US$100 million senior notes to ABC International through a private offering, and subsequently issued a US$250 million senior notes which was well-received by international capital markets and was oversubscribed by 6.5 times. When the China authorities loosened the limitation on issuers of domestic corporate bonds early 2015, the Company responded proactively and successfully issued RMB2.4 billion domestic corporate bonds at a coupon rate of 5.80%.

Outlook for the Second Half of 2015

Aoyuan management commented, “Amid new normal conditions of the Chinese real estate industry, Aoyuan will continue to sustain steady development whilst grasp market opportunities. We will upgrade composite real estate model with themes of cultural tourism, regimen and senior care, while facilitating parallel development in domestic and overseas property markets. In addition, Aoyuan will utilize mobile internet technologies to provide more value-added services, boosting sales growth. Hence, we strive to deliver sustainable returns to our shareholders.”

-End-