Aoyuan Announces 2016 Interim Results

Revenue Surges 65% to RMB6.48 Billion

Strong Sales Growth with Optimized Debt Structure

Date:2016-08-18

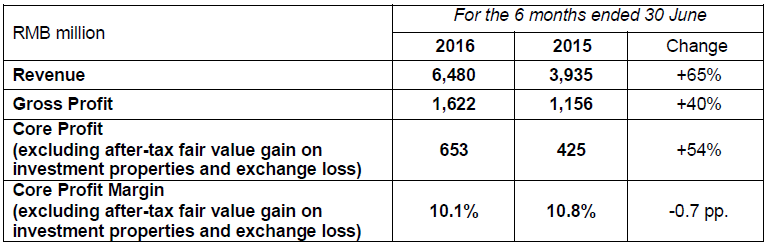

Financial Highlights

(18 August 2016 – Hong Kong) China Aoyuan Property Group Limited (“Aoyuan” or the “Company”, Stock Code: 3883), a renowned property developer in China, is pleased to announce its unaudited interim results for the six months ended 30 June 2016.

Strong Sales Growth with Sustainable Operating Performance

During the first half of 2016, the Company maintained strong growth momentum and achieved revenue of approximately RMB6.48 billion, representing a y-o-y increase of 65%. Gross profit rose by 40% to approximately RMB1.62 billion, with gross profit margin at approximately 25.0%. Core profit (excluding after-tax fair value gains on investment properties and exchange losses) increased by 54% y-o-y to approximately RMB653 million; core profit margin was 10.1%.

Aoyuan recorded a 73% y-o-y increase in contracted sales to approximately RMB10.53 billion for the first six months of 2016, achieving 62% of its full-year sales target. Contracted sales from Guangdong province and non-Guangdong province accounted for approximately 50% and 46% respectively, while sales from overseas projects accounted for approximately 4%.

Aoyuan has made a new step towards parallel development in domestic and overseas markets. Its first overseas project, One30 Hyde Park Sydney, has recorded contracted sales of approximately A$305 million (equivalent to RMB1.53 billion) since its pre-sale in August 2015 to July 2016, representing 80% of the project’s total sales. Maison 188 Maroubra Sydney, developed independently by Aoyuan, successfully obtained development approval in June 2016, and is expected to launch for presale in mid August 2016 with positive market response.

Aoyuan continued to adopt a prudent land acquisition strategy in the first half of 2016 and has entered into the Shenzhen and Chengdu market in an effort to continuously optimize its land bank in Tier 1 and 2 cities. During the period, the Company acquired a total of 4 quality projects, representing newly added gross GFA of approximately 1.39 million sq.m.. As of 30 June 2016, Aoyuan possessed a total land bank of 13.76 million sq.m. in GFA, which is sufficient for the development needs for approximately five years.

Sound Financial Performance with Debt Structure Continuously Optimized

Aoyuan maintains prudent financial management while actively diversifying its onshore and offshore financing channels, further optimizing debt structure and lowering borrowing costs. In April 2016, Aoyuan issued a US$250 million senior notes at par with a 6.525% coupon rate, which was oversubscribed by 8.8 times. Aoyuan has redeemed the US$100 million 9.25% private senior notes due 2018, following the completion of redemption of US$225 million 13.875% senior notes due 2017. In addition, Aoyuan has facilitated the first cooperation between the Commonwealth Bank of Australia and China’s Big Four Banks, namely Bank of China, Industrial and Commercial Bank of China, and China Construction Bank, to provide a syndicated loan of approximately A$197 million for One30 Hyde Park Sydney with the total borrowing costs at below 5% per annum.

As of 30 June 2016, the net gearing ratio was kept at a reasonable level of approximately 56.0% while the business was on a fast growth track. Aoyuan maintained sound financial performance. Its cash collection ratio remained at a relative industry-high level of 90%, and total cash (including restricted cash) was approximately RMB10.21 billion.

Outlook for the Second Half of 2016

Aoyuan management commented, “During the first half of 2016, Aoyuan has continued to enhance its product competitiveness and to innovate the marketing model amid supportive policies, achieving an encouraging performance. Looking forward to the second half, Aoyuan will adhere to the strategy with a main focus on Tier 1 and 2 cities and developing commercial and residential properties in parallel. We will reinforce its footprint in the Pearl River Delta, and target cities with large markets and strong demand, as well as facilitating parallel development in domestic and overseas markets, to achieve sustainable business development, while delivering satisfactory returns to our shareholders.”