Aoyuan Announces 2017 Interim Results

Contracted SalesReaches RMB16.5 Billion Achieves 50% of the Full Year Target

Net Profit Increases 43% YoY to RMB858Million

***

Qualified as Eligible Securities under Shenzhen-Hong Kong Stock Connect

Date:2017-08-17

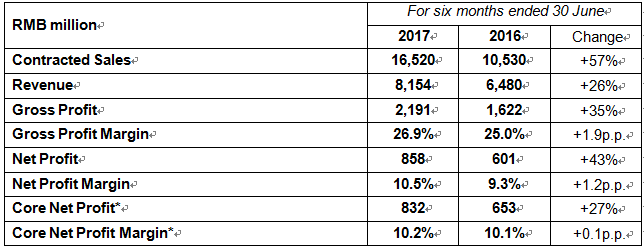

Financial Highlights

*(excluding fair value gain on investment properties, loss on earlyredemptions of senior notes, net exchange gain and loss on change in fair value of derivativefinancial instruments)

(16 August 2017 – Hong Kong) China Aoyuan Property Group Limited (“Aoyuan” or the “Company”, Stock Code: 3883), a renowned property developer in China, is pleased to announce its unaudited interim results for the six months ended 30 June 2017.

RobustSales Growth with Strategic Footholdin the Guangdong-Hong Kong-MacauBigBay Area

In the first half of 2017, the Company maintained strong growth momentum. The contracted sales surged 57%y-o-y to approximately RMB16.52 billion, achieving approximately 50% of the full-yeartarget of RMB33.3 billion. Contracted sales from the Guangdong-Hong Kong-MacauBigBay Area(“the Big Bay Area”), such as Shenzhen, Guangzhou and Zhuhai, amounted to RMB9.93billion, accounting for 60% of the total contracted sales.

During the period, Aoyuan continued to achieve a steadygrowth in profitability.Revenue increasedby26%y-o-y to approximately RMB8.15billion. Gross profit increased by 35% to approximately RMB2.19billion, with gross profit margin increasing by 1.9p.p. to26.9%. Net profit increased by 43% y-o-y to approximately RMB858million, while net profit margin increased by 1.2p.p. to10.5%.Core net profit increased by27% y-o-y to RMB832million, while core net profit margin maintained at10.2%.

Aoyuan adhered toits land acquisition strategy withmainfocus on Tier 1 and Tier 2 cities and supplemented byTier 3 and 4 cities. Leveraging on its diversified land acquisition channels, the Company has acquired 20quality projects through land auctions andacquisitions, etc. in the first half of the year with newly added GFA of approximately 3.70 millionsq.m..Based in Guangdong, Aoyuan has seized the first-moveropportunities intheBigBay Area. The Company has 40 projects with total GFA of approximately 4.80 millionsq.m.inGuangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Zhongshan, Jiangmen and Dongguan of the Big Bay Area. As of 30 June 2017, Aoyuan had a total land bank of approximately 17.12million sq.m.in GFA, which is sufficient for the development needs in the nextthree to four years.

Aoyuan also achieved satisfactory progresstowards parallel developments in domestic and overseas markets. The four quality projects in Sydney, Australia, namely One30 Hyde Park,Maison188 Maroubra, Altessa 888 Gordon and MirabellTurramurra, are well received by the local market, which fully demonstratesthe Company’s strongexecution capabilities in the overseas market. Among which, One30 Hyde Park,Maison 188 Maroubra and MirabellTurramurrahave commencedconstruction successively.It makes Aoyuan one of the fewPRCdevelopers in Australia to reach construction phase. In addition, Aoyuan acquired two quality projectsinVancouver, Canadain the first half of 2017. The Company remains committed to its localization strategyin order tobuild a solid foundation for Aoyuan’s sustainable development in the overseas markets.

Well Recognized for Solid Financial Position

Aoyuan upholds a prudent financial management while diversifying its onshore and offshore financing channels. It has continued to lower its borrowing costs and optimize its debt structure. In January 2017, Aoyuan became the first Asian issuer to complete US$250 million 6.35% senior notes which was 10 times oversubscribed. The Company secured HK$1.5 billion dual currency club loan from Hang Seng Bank, Nanyang Commercial Bank, Bank of East Asia, Chong Hing Bank, Chiyu Banking Corporation and Wing Lung Bank in February. In addition, the Company has completed the early redemption of an aggregate principal amount of US$300 million 11.25% senior notes as planned. As of 30 June 2017, the net gearing ratio of the Company was 63% at reasonable levels on par with the industry. Total borrowing costs further decreased from 8.1%at the end of 2016 to 7.6%.

Benefiting from its robust business growth and healthy financial profile, Aoyuan became the only PRC developer withcredit rating upgrades by all three major international rating agencies, namely Fitch “BB-”, Moody’s“B1”, and Standard & Poor’s“B+”. The Company’s onshore corporate rating has also been upgraded to “AA+” by United Credit Ratings in China, demonstrating wide recognition of Aoyuan’s profitability and comprehensive strength by capital markets and the public.

Successfully qualifiedas Eligible Securities under Shenzhen-Hong Kong Stock Connect

According to the latest Index Review Results announced by Hang Seng Indexes Company Limited on 16 August, Aoyuan was successfully included in the List of Eligible Securities for Southbound Trading under Shenzhen-Hong Kong Stock Connect, which will be effective on 4 September. It indicates that qualified mainland China investors will be able to participate directly in the trading of Aoyuan’s shares. The qualification as eligible securities for Southbound Trading will further enhance the liquidity of Aoyuan’s shares, optimize shareholders structure and strengthen brand awareness, resulting in a reflection of Aoyuan’s long-term corporate value.

Outlook for the Second Half of 2017

Aoyuan management commented, “In the first half of 2017, Aoyuan maintained strong growth momentum by strategicallyseizing market demand and adopting a flexible and innovative sales strategy. Looking forwardinto the second half of the year, wewill further strengthen the balanced layout of cities andmaintain its focus on the Tier 1 and 2 cities and the surrounding cities. We will optimize strategic layout in theBigBay Area, and expand in the Yangtze River Delta andcore region of Central and Western China, whilefacilitatingparallel development in domestic and overseas markets to ensure strong growth,thusdeliveringfruitful returns to its shareholders and investors.”

Remarks: The latest Index Review Results announced by Hang Seng Indexes Company Limited can be referred to this link:

http://www.hsi.com.hk/HSI-Net/static/revamp/contents/en/news/indexChgNotice/20170816e.xls

Aoyuan Management Announces 2017 Interim Results

Aoyuan 2017 Interim Results Investors Presentation